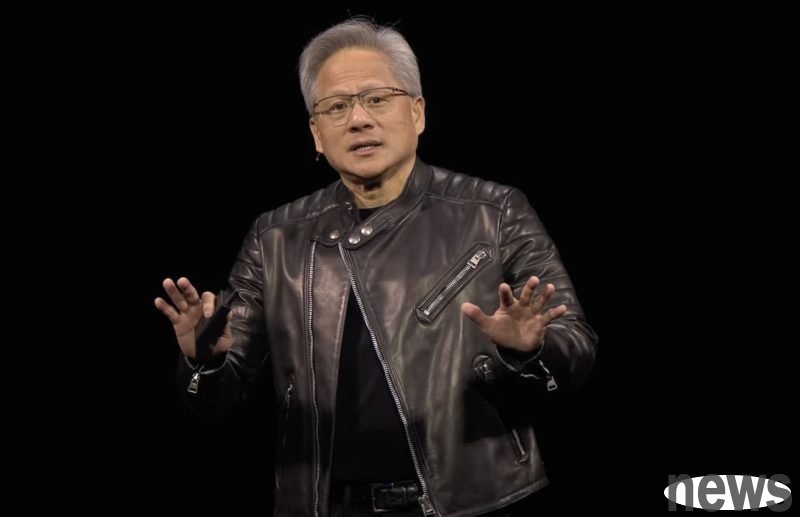

The United States continues to tighten the export control of China's artificial intelligence chips, and originally prohibited NVIDIA (NVIDIA) from exporting H100 chips to China. Then, the reduced version of H20 chips was restricted from selling them to China. However, the US government finally officially put forward broad export controls on H20 chips on July 15, 2025. When visiting China, NVIDIA executive chief Huang Renxian said that he would resume H20 chip sales and hoped that more advanced chips would enter the Chinese market in the future.

Regarding this kind of change, the Asia Times Report stated that China is cautious about this development. Some commentators believe this is not good for China's chip manufacturing industry. Because these commentators believe this is not a problem of purely lifting export restrictions, but rather a carefully designed measure by the United States to maintain China's technological lockdown. And the main reason for this comment comes from the following facts:

First, the H20's FP16 computing power is only 15% of the H100, the NVLink bandwidth has been reduced from 900GB/s to 400GB/s, and the H20's Transformer Engine (TE) has been completely deleted. Although this design ensures the chip's AI recommendation capabilities, it greatly reduces its AI training capabilities, perfectly implementing the American strategy of blocking high-level chips but not medium-level chips. This situation is applied to Chinese technology companies, indicating that they can benefit from foreign AI chips in the short term, but will miss the opportunity to develop and build their own ecological systems.

The report quoted the market commentator's statement that NVIDIA's Huang Rensheng is this clever and cunning, intending to curb China's chip industry. Because the computing power of a single H20 chip is far lower than that of H100, and the reduction in interconnected frequency width represents a significant weakening of AI training capabilities. Since AI training is similar to thousands of people working together, it requires rapid information exchange, and low interconnection bandwidth will lead to slow communication and low thinking efficiency. Therefore, H20 wafers cannot be used to train a multi-parameter large language model (LLM).

In addition, although the H20 generously offers the 96GB third-generation high-frequency wide memory (HBM3), which is higher than the 80GB HBM3e of the H100, its memory bandwidth is only 4.0 TB/s, and lower than the 4.8 TB/s of the H100. This is likened to someone giving you a larger table to read more books, but it makes it harder for you to pick up books from the shelves. Therefore, market commentators will believe that the broader H20 export control is to allow the United States to accurately control the speed of China's AI development. A Chinese software engineer also pointed out that the H20 is more than a Ferrari that has a powerful V12 engine but has been downgraded with a fuel pipe, gearbox and car wheel, which allows this Ferrari to drive normally on the straight road, but faces restrictions when it continues to accelerate or quickly turn.

The report stated that the Chinese Internet major manufacturers, including word-to-length jump and news, are applying for H20 chips, although word-to-length jump rejected this report. Overall, NVIDIA's H20 product revenue reached $4.6 billion before the new export permit requirements came into effect, and another $2.5 billion was unable to ship due to restrictions. Although the Hsing 910B chips in China perform better in many aspects of AI training, NVIDIA's H20 chips will still play a good role in the Chinese market. This is because NVIDIA's CUDA platform is more advanced than the MindSpore framework used by China, resulting in customers not willing to use non-NVIDIA chips. For example, Alibaba is using H20 chips to move its existing AI systems, while Sheng Teng 910B chips may be mainly for state-owned enterprises. Market forecasts that in the face of high cost of converting enterprises to new platforms, NVIDIA's CUDA platform will continue to occupy 80% of the Chinese market in the future.

At the same time, the US government has also increased its efforts to prevent the transfer of NVIDIA's high-level chips to China, such as urging Malaysia and Thailand to restrict such transfers. Among them, the Malaysian government announced on July 14 that the export, transfer or transit of high-performance AI chips from original US will require trade permission, and the company must notify the government at least 30 days before shipment. Therefore, the continued development of the whole thing and its impact on the market still need further observation.