Gold fell 1.33% to $3,251.1 per ounce.

The US federal court prevented the Trump administration from taking effect, and the US dollar and U.S. stock futures index rose.

Chen Dade, chief strategist at Asia of Oriental Wealth Management, also said: "The market is only responding to various news that are beneficial or unfavorable to future growth. Therefore, investors should be prepared to deal with various news and look at the long-term, rather than short-term transactions on various news. The US government's deficit and debt are still worrying, and the US dollar is seriously undervalued. This situation will continue for some time until the fiscal issues become clearer."

Dow Jones futures and S&P 500 futures both rose about 1.1% and 1.5% as of Thursday (May 29) at around 9:50 a.m. The dollar index, which reflects the dollar's dollar against a basket of major currencies, rose by around 0.4% to 100.29.

In the Asian stock market, the Nikkei 225 index rose 1.4%, the Hong Kong Hang Seng index rose 0.2%, and the Singapore Straits Times index fell 0.1%.

The Trump administration has appealed against the federal court's ruling.

Zhang Shuxian, head of exchange rate and interest rate strategy at OCBC, said the federal court's ruling temporarily boosted risk sentiment, with stock index futures, bond yields and the dollar rising.

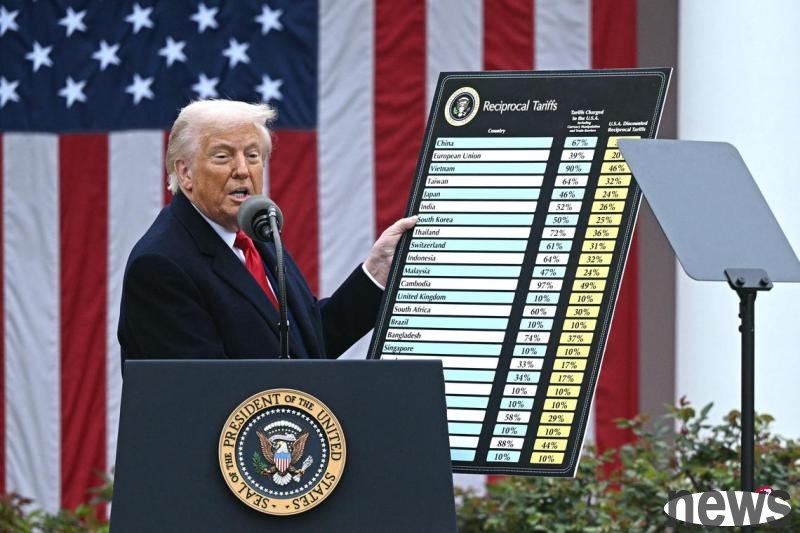

Capital.com senior financial market analyst Kyle Rodda said: "This is a big news. There have been long-standing beliefs that Trump's executive power to impose tariffs is unconstitutional and that the power to set tariffs belongs to Congress. This will trigger a situation that is likely to eventually resort to the Supreme Court. It is a dangerous situation because the Trump administration may ignore the court's ruling."

Charu Chanana, chief investment strategist at Saxo Markets, pointed out that the Trump administration still has room for appeals or imposes tariffs on specific industries, so policy uncertainty remains.

"For bonds and foreign exchange, this is conducive to continuing the recent trading trend, the US dollar has shown signs of rebounding, and long-term bond yields are also under upward pressure. Despite this, the development of tariffs and trade relations remains uncertain, and investors are likely to be reluctant to repossess either."