Speaking of asset allocation, I must share with you my failed investment experience. This story happened when I was 15 years old (third year of junior high school). At that time, I just started to invest, and no one taught me at all. I could only rely on some books and online learning, which led to me taking a lot of detours on the investment road.

That year, I was very fond of days when I held a lot of dividends and dividends every year, so I went online to find the yield ranking of Taiwan stocks (dividend per share [cash dividend] ÷ price per share × 100), and then selected Taiwan terminal (3432) and Dayi Jinmao (8107) as investment tags.

At that time, I was blinded by the unreasonable yield rate and without knowing the two companies, I easily dumped all my assets. After the Taiwan Post announced the high yield rate that year, the board stopped for several days. Therefore, I was even more sure that I had chosen a good stock, but the good times were not very good. I remember that not long after the ex-privileges date, the stocks on the Taiwan Post fell into an endless decline, which basically caused my assets to be under the waist. Although I later gained a lot of dividends, the price difference and dividends combined, my assets still evaporated by 25%.

The ridiculous thing is that after I saw that I joined the teacher again, he asked me what stocks did I invest in? I happily showed him my securities account, and it was not until a long time later that I recognized the departure and moved the assets to a place where I could really make money for me.

My failure experience is worth borrowing the mirror.I made a lot of mistakes. The following list is for your reference. I hope you can use it as a preview of the front car to avoid the same mistakes as me.

1. Invest in an unfamiliar company

I surrendered myself! Before I looked at the yield rate rankings, I had never heard of this company on the Taiwan side, and I had not read the fundamentals of this company before deciding to invest. I want to clarify here that I am not saying that the platform is not good, but I want to tell everyone that you should not invest in a company that you don’t know at all.

2. Not willing to admit that investment failure seems simple, but in fact it is extremely difficult. It is never easy to admit that one's own shortcomings and failures are never simple. It's not inconsistency. Since I always believe that the stocks in my hands will return to the high point one day, I wait for that day to arrive every day. I said I would have been thinking about it at that time, mainly because Buffett once said, "People who cannot afford to fall 50% of the stock price should not trade stocks!" (Unable to bear 's shares fell 50% of the people should not have to fry.) So, I was sympathetic and continued to hold on to this stock that would not grow in the next year, and gave up other better investment opportunities. After I went to high school, I had been slapping and considering for a long time before I decided to "break up" with this stock.

3. Super bad asset configuration

is finally about to talk about the key points of this chapter! I think no matter whether I have studied investment or not, I should have heard the sentence "Don't put chicken eggs in the same bag" more or less, and what this sentence itself means is the importance of spreading the risk. In this example, I have put all my assets in the same company, which has caused great risks; in other words, if this company has any problems in its operation, I have no ability to resist the risks I face. Therefore, we need to learn how to allocate assets so that we can achieve the best balance between compensation and risk.

How to create an asset configuration that belongs to oneselfFirst of all, I want to say that everyone should have a set of asset configuration that belongs to oneself. Why can’t we directly copy other people’s investment allocation? The reason is simple, because the investment method that everyone is suitable for is different from the risks they are willing to bear. For example, today an 80-year-old girl received the same financial education as an 18-year-old girl and both decided to invest in the Taiwan market, but their asset allocation is likely to be different.

The long-term investors must have a higher demand for "stability". After all, she has no energy to create active income, so cash, bonds and Taiwan 50 (0050) must account for the majority of her asset allocation. Because the 18-year-old girl has a lot of energy to create active income and has a long life, even if she fails to invest, she still has the opportunity to make a comeback. Therefore, she can put more stocks in the girl's investment portfolio, and even take a small part to serve as a bar. This is reasonable.

Of course, age is just one of the factors that affect asset allocation. The reason why it really affects asset allocation is that it is not enough. Before you configure your own assets, I hope everyone will know how much risk tolerance is and how much volatility it can withstand. If you want to simply understand your risk tolerance, just ask yourself, you are usually a person who loves to risk or a person who is a little more conservative. As for how much cash is needed, a simple method is popular in the civilian investment community, that is, how much percentage is increased at the age of time.

For example: I am 20 years old this year, I will give 20% of my cash, so that the other 80% will participate in the market operation.. This principle is very simple. As the beginning of this chapter says, the younger the older the risk, the higher the risk tolerance, and even if you lose all, you can still make money by working. However, if you are young and don’t like to take risks, of course you can also improve your cash position according to your own wishes to avoid it. For example, I like to make my cash account for 25%. Of course, you don’t have to learn from me. Finding a comfortable configuration method is the most important thing. In short, it is necessary to decide the cash position before creating a dedicated asset allocation. After deciding the cash ratio, the second step is to decide the investment target.

If you are a novice in investment, I usually recommend starting with a regular fixed ETF. Regarding this part, I have a detailed explanation in Chapter 6. If you forget it, you can turn it back and revise it. If you have special interest in stocks that you want to invest, of course you can also put them in your investment list. However, I sincerely hope that the stocks you invest in are not from the clear card, and you will definitely not be able to make it easy for you to invest.

Turning to the US stock market from the Taiwan stock marketIf you want to invest in stocks, I still recommend choosing US stocks. Of course, if you are familiar with the Taiwan market, you can also ignore my words directly. If someone says I am a protector of the US stock market, I will not deny it at all. So, I want to share here why I am fighting the US stock market from the Taiwan Stock Market:

1. Capital amount

How much is a Taiwanese company worth? How much is an American company worth? I think everyone has a bottom line in the gap between these two. Of course, there are more or less exceptions here, such as Taiwan Electric Power, which is a living example. In most cases, the capital amount of first-class companies listed in the United States is very large. If the capital amount is too small, most of the stocks will easily gather on a small number of shareholders, which will cause major shareholders to have a certain ability to operate stock prices. However, in the Taiwan market, the behavior is commonly known as "speculating stocks".

In addition, in the world of internal trading, the vision and strength of Caifeng investors is completely useless, because the stock market no longer relies on natural laws to operate, and I also believe that speculation of stocks and internal trading is a major reason why Taiwanese investors can easily spend money.

2. Brand Value

What are the most well-known stocks in Taiwan? Seeing this problem, many investors' brains are all about Daliguang, TECH, medium steel, etc. But think about it carefully, how many of these stocks are international brands? In Taiwan, most of the most powerful stocks are used to provide foreign OEM, and it is not that OEM is not good. After all, Taiwan Electric has achieved the highest ranking in the crystalline chip market. But what I mean is, look at the big foreign companies, such as Google, Microsoft, etc., they are responsible for innovation and invention, and they can even be said to lead the world's trends and create a new future. They all have international influence that Taiwanese companies cannot reach. If we let the funds grow with these world-class companies at this time, it would be very exciting.

3. Familiarity

People always say they want to invest in companies they are familiar with, but the Taiwan Stock Exchange is full of companies that novices don't recognize. If they don't study it carefully, they will not know the characteristics and future development of that company. In the world of US stocks, there are many brands that we are very familiar with, and even those companies are closely related to our lives, such as Coca-Cola (KO), Starbucks (SBUX) and NIKE (NKE), which are all companies that everyone is familiar with. So if you have not studied the Taiwan Stock Exchange, you might as well try to see American stocks! Again, buying US stocks is just my personal recommendation. If investing in foreign stocks makes you feel less secure, then Taiwan stocks are still a good choice. As for how to choose stocks, I will share with you a trick —— stock selection method for people.

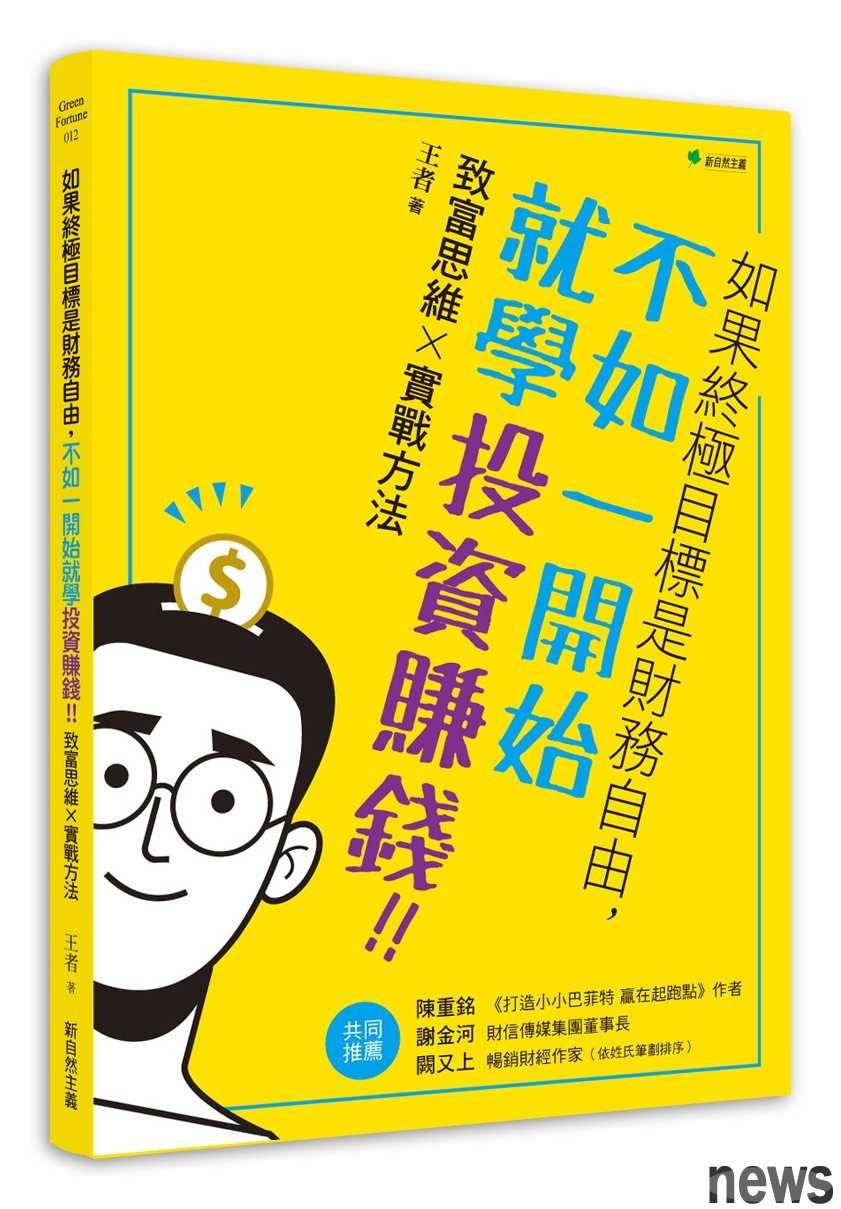

※This article extracts the natural theory "If the ultimate goal is financial freedom, it is better to study investment and make money from the beginning! ! :X-Practical Methods for Thinking about Getting Rich》